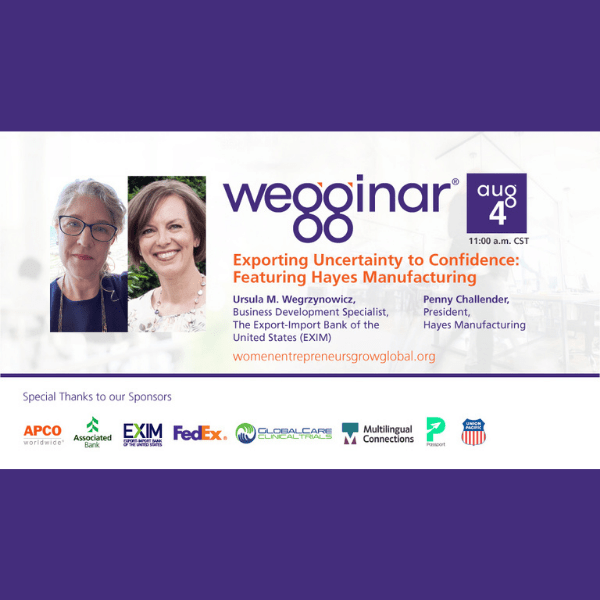

wegginar presenters Penny Challender, President, Hayes Manufacturing and Ursula Wegrzynowicz (pictured below), Business Development Specialist, The Export-Import Bank of the United States (EXIM) recently discussed “Exporting Uncertainty to Confidence: Featuring Hayes Manufacturing.” At the end of the wegginar, we promised attendees we would follow up and address all their questions.

…