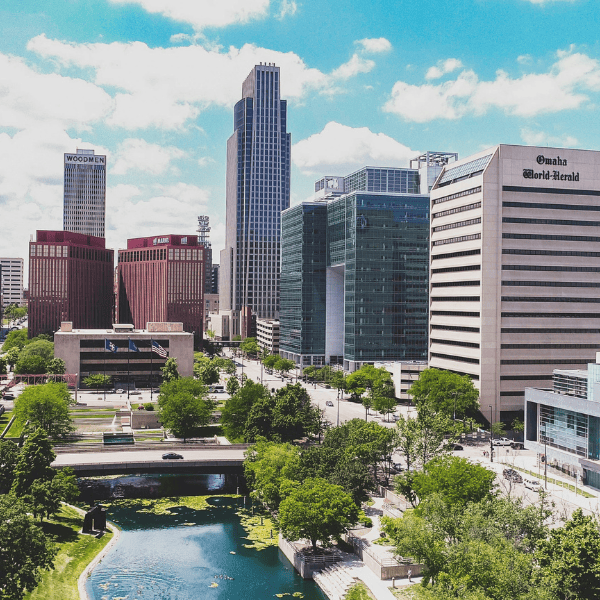

We are big fans of the mighty finance genius Warren Buffett and make it a practice to read his annual report. This year was no exception. In his annual letter to shareholders Saturday, Warren Buffett celebrated the successes of Berkshire Hathaway’s (BH) companies last year and in the 60 years since he took over a struggling New England textile company and began converting it into a massive conglomerate while offering some advice to President Donald Trump.

…